Ben Beattie

December 2021

First published online in The Spectator Australia

Public figures such as Twiggy Forrest and Alan Finkel are closely associated with the push to have green hydrogen replace coal in power generation and steel making and replace oil in transport. Bureaucracies such as AEMO, CEFC, ARENA and state and federal governments are rushing to cough up taxpayer funds with the same ultimate goal. However, the associated construction of massive quantities of wind turbines and solar panels incurs enormous adverse consequences for both the environment and the Australian economy. In its draft 2022 Integrated System Plan (ISP), the Australian Energy Market Operator (AEMO) envisages this expansion in one of its four scenarios, seeing Australia’s wind and solar capacity increasing ninefold.

The renewables lobby, well versed in the use of propaganda, has predictably assigned the term ‘green hydrogen’ to hydrogen gas extracted from drinking water using electrolysis powered solely by wind and solar. Extracting hydrogen from methane (the industry standard) has been labelled ‘grey’ hydrogen, possibly because calling the process ‘brown’ or ‘black’ would trigger racial outrage. Perhaps the retirement industry should be consulted on all uses of the colour grey…

Theoretically, hydrogen is an unlimited clean energy source. Hydrogen (H) is the most common atom in the universe, but the hydrogen gas molecule (H2) cannot be dug up like coal or drilled like methane and oil – it must be refined. Being the smallest and lightest gas, and being highly explosive, the technical challenges of H2 apply to hydrogen gas however it is produced. BHP attempted to utilise hydrogen gas to produce green steel at Port Hedland Boodarie Iron from 1999, resulting in write-downs after tax of $1.7b, a fatal explosion and closure of the plant in 2004.

While the physical properties of hydrogen gas make it difficult to store, transport and consume, green hydrogen production also has significant economic challenges to overcome. To illustrate, let’s consider South Australia, where the ABC reports the latest green hydrogen project in Port Pirie has received government funding.

Using standard inputs such as capacity factor of wind and solar (0.3), electrolyser efficiency (50 kWh/kg) and 2021 Q3 average SA spot price ($60/MWh), we can see that the cost of electricity to produce green hydrogen in SA is $3/kg. The producer must then add the costs of capital, maintenance, wages, insurance, tax, water, storage facilities and any costs required to convert hydrogen into ammonia or other useful products. By contrast, domestic hydrogen production by the standard Steam Methane Reforming process (grey hydrogen) costs around $2/kg, all in.

Angus Taylor has flagged $2/kg as an aspirational target for the cost of producing green hydrogen, and many assume the electrolysis plants will utilise excess free power from wind and solar. The major input cost on green hydrogen is the electricity price, so how does one obtain ‘excess free’ electricity?

Enter government-created market distortions. The wind / solar generator receives a subsidy (e.g. Renewable Energy Certificate) for generating zero-emissions electricity, which enables them to offload the electricity to a hydrogen electrolyser, who then receives ‘free’ electricity – everybody wins except whoever is paying the subsidy. Alternatively, with so much wind and solar being curtailed by the market operator due to oversupply, a small electrolyser may be able to use periods of negative prices in the electricity spot market, although these periods are often only during the day when solar power is rampant.

Electricity market design utilises negative prices to indicate periods of oversupply. While it is true that negative wholesale prices are increasing in duration and frequency, this growth is an unnatural phenomenon, a result of government intervention forcing wind and solar into the grid even as the market screams “NO”. It is a significant leap to see a successful hydrogen industry dependent on negative electricity prices driven by arbitrary government policies. Investments cannot be underpinned by assumptions these market distortions will remain long-term.

Taking QLD’s new government-owned wind power station, the 102 MW Karara, will cost $250m to construct according to budget papers. Assuming 0.3 capacity factor and 25yr life, the wind power station must earn $37/MWh just to pay back the capital. This excludes interest, operational costs and any other expenses. The simple facts are that wind and solar power stations are not free to build and operate and cannot supply free electricity.

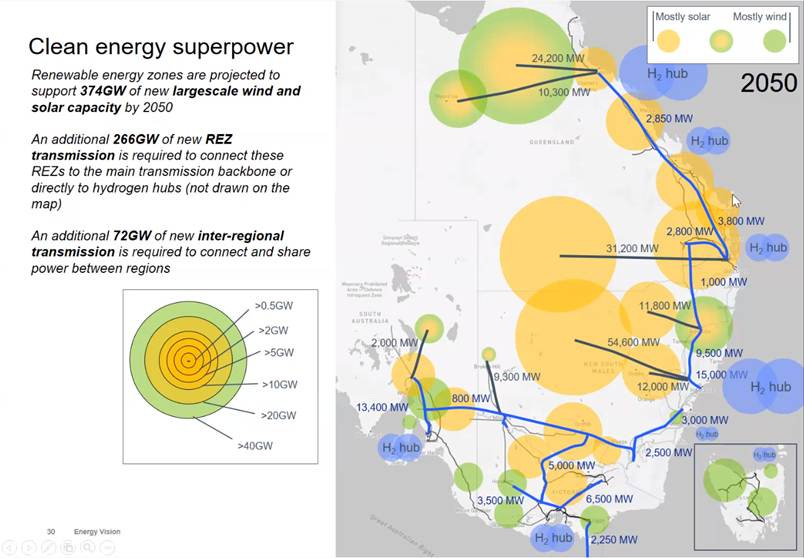

Recently I highlighted the drooling anticipation of the renewables industry as it contemplates the taxpayer-funded expansion of wind and solar capacity necessary to produce enormous amounts of green hydrogen (Spectator Australia, 22 Oct 2021). The image below, taken from a recent Transgrid webinar, is a prime example of the results of inexperience and ideology mixed with self-interested activism.

Source: Transgrid energy vision webinar 2 November 2021

The total annual electricity generation for the state of South Australia (12 TWh) would only produce 0.24 Mtpa green hydrogen, while consuming 2,160 megalitres of drinking water (around 10,000 homes). Scaling up to Twiggy Forrest’s suggested 15 Mtpa would require construction of enormous wind, solar and transmission capacity, similar to that promoted by Transgrid above, and by AEMO in their 2022 draft Integrated System Plan. How can the electricity infrastructure at this scale ever be zero cost? Apart from the cost, even the ABC has been forced into covering the environmental damage from the expansion of renewables to date. Plans for future expansion makes environmental consequences to date look miniscule by comparison.

The discussion above focuses on just the production of green hydrogen, but without an equivalent increase in consumption, all this activity is for nought. Hydrogen is only mentioned once in BP’s Statistical Review of World Energy, in a small paragraph about the future. In fact, global consumption of hydrogen gas was only around 70 Mt/yr in 2018, as documented by the International Energy Agency in their 2019 Future of Hydrogen Report. This report includes seven recommendations. The first four require government intervention in the form of both financial and policy support to promote hydrogen gas production, storage, transport and demand.

The CEFC’s Australian Hydrogen Market Study 2021 puts domestic hydrogen production in context:

“Australia’s current hydrogen production is around 650 ktpa and virtually all of this hydrogen is made using Natural Gas Steam Methane Reforming (NG SMR) and is immediately consumed by the associated ammonia synthesis (≈65%) and crude oil refining (≈35%) plant.”

Hydrogen must be compressed or liquified to be exported in its pure form or converted into a product like ammonia. All these conversions add cost to the supply chain. The CEFC report estimates liquefaction adds $9/kg. For those costs, it would make sense for potential green hydrogen markets like Japan to utilise nuclear power to generate hydrogen locally. This has obvious consequences for Australia as a ‘hydrogen superpower’.

The media is largely missing in action on several important questions:

Who pays for the massive expansion of transmission?

How are the vast amounts of wind turbines and solar panels dealt with at the end of their short life?

Where are the vast amounts of wind turbines and solar panels manufactured?

Where is the green hydrogen market?

What are the environmental consequences?

What happens to our electricity market?

Why wind and solar, and not nuclear?

It is difficult to find adjectives that adequately convey the quantities of raw materials, land, electricity and water consumed in the production of this ‘green’ hydrogen vision. The numbers don’t add up.

Find the latest at The Baseload Podcast.

You are so right, Ben, and thank’s for calling this out for the billion-dollar sham that it is. Anyone who has been engaged in the operations area of power generation has first-hand knowledge and experience of the pitfalls associated with Hydrogen production, distribution and storage, not to mention the critical maintenance and emergency response risks when things go awry. We can attest to the utter BS being spruiked by those who are after a fast buck, and you have nailed it. But, beware, we have a gullible idiot for an energy minister and a government which believes anything they’re told that fits with their ideological stampede for an impossible green dream. Keep up the great work.